MACRS

- Soham Mukherjee

- Jul 29, 2018

- 1 min read

1) Current system allowed in the USA to calculate the deductions of depreciation on depreciable assets. Stands for Modified Adjusted Cost Recovery System.

2) Allows for larger deductions in early years and lower deductions in later years. Comprises of the following components in its calculation.

a) Depreciable basis: Purchase price + transportation + installation cost

b) Recovery period: Length of time over which the asset is depreciated. Depends on the “class” of the asset which is already determined.

c) Allowance percentages: Set of allowance % for each recovery period when multiplied by the basis given in each year’s depreciation expense.

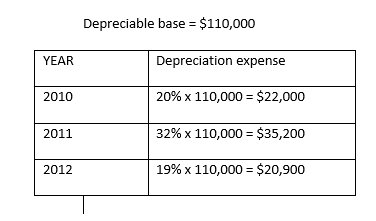

3) Example: Consider a Truck costing a total of $110,000 bought in 2010. According to the system of classification, this is a 5 -year item with allowance percentages to be 20% in Year 1, 32% in Year 2 and 19% in Year 3. The depreciation schedule for the first 3 years would look as follows.

Depreciable base = $110,000

4) Book value at the end of any year = Depreciable basis – Accumulated depreciation till that year

5) MACRS declining balance changes to the straight-line depreciation method when the method provides equal/greater deductions.

-Soham Mukherjee

Editor in Chief

Comments